By this point in your studies you know that, generally speaking, equity securities are riskier than fixed income securities. With that in mind, you would think that a portfolio made up entirely of bonds would be safer than a portfolio that consists of mostly bonds with some exposure to Stocks – but this isn’t necessarily the case.

Consider the following scenario: Mike is a conservative investor who invested his entire portfolio in bonds. Recall that interest rates and bond values have an inverse relationship. If interest rates go up, it puts downward pressure on the market value of existing bonds. For example, all else being equal, if an existing bond has a 3% coupon rate while newer bonds are being issued with a higher coupon rate of 4%, the existing bonds would be considered inferior and their market value would fall. Mike was complaining to his friend, Josh, that since interest rates have steadily increased, his bond portfolio is down in value. Josh responded by saying that his portfolio isn’t doing that great either, but fortunately 10% of his portfolio is invested in stocks and those investments are doing quite well.

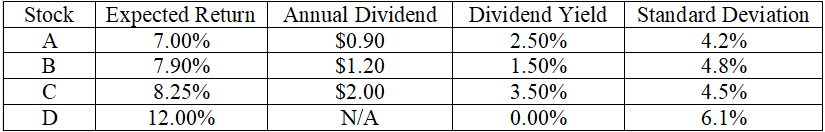

An economist by the name of Harry Markowitz defined an efficient portfolio as one that has the highest expected return for a given level of risk. He argued that by choosing investments from various asset classes, investors can create an efficient portfolio which maximizes the return for their desired level of risk. The portfolio that has the highest expected return for a certain level of risk lies on what Markowitz called the “efficient frontier”. Let’s look at a question together which will help us illustrate this concept. You’ll now see [below] information pertaining to four different stocks and you’re being asked which one would definitely not fall on the efficient frontier?

Given the information below, which of the following stocks would definitely not fall on the efficient frontier?

a) Stock A

b) Stock B

c) Stock C

d) Stock D

Recall that Markowitz defined an efficient portfolio as the one that has the highest expected return for a certain level of risk. So to answer this question, we need to focus on two things. Number one, the expected return, and number two, the standard deviation, which is the measurement of risk.

First, let’s get rid of all the distracting stuff by removing the columns that have information that we don’t need to answer this question [seen in video]. Next, let’s put the investments in order from lowest risk to highest risk based on the standard deviation [seen in video]. From there, it’s pretty straightforward; as the standard deviation increases, (i.e. as the risk increases), the expected return should increase too. If it doesn’t, why on earth would you accept the added risk? Alright, let’s take a closer look at each investment.

- Stock A has the lowest standard deviation of 4.2% and lowest expected return of 7%.

- Stock C represents more risk with its higher standard deviation of 4.5%. In exchange for accepting more risk, notice the investor is rewarded with a higher expected return of 8.25% – make sense so far.

- Stock B represents even more risk as it has a higher standard deviation of 4.8%. But wait a minute, it has a lower expected return and Stock C, well, that’s not very “efficient” at all. An investor would be foolish to accept more risk for a lower expected return. Therefore, we can definitely conclude that Stock B would NOT fall on the efficient frontier.

- To be sure, let’s take a look at Stock D. It has the highest standard deviation and the highest expected return, so that checks out.

To be clear … we cannot say for sure that stocks A, C, and D are the most efficient portfolios at each risk level, but it is possible. However, when it comes to Stock B, we can definitely say that it would NOT fall on the efficient frontier.