In this week’s video blog we’re going to cover what deflation is and why it’s bad for an economy. Fiscal policy deals with things like government spending and taxation. Monetary policy involves things like money supply, interest rates, and of course, inflation.

If you’re a Canadian Securities Course® student watching the news these days, this may be an interesting and educational video for you. Now, regardless of your political stripes, or even if you don’t follow politics at all, knowledge is still power. And this lesson may give you the opportunity to apply some of what you’ve learned in the CSC® to a real-world scenario. But before I move on, I want to let you know that as an educational provider, SeeWhy Learning is nonpartisan. Our aim is to educate, not influence one way or the other. The government of Canada has two main types of tools at its disposal, to help nurture, protect, and grow the economy.

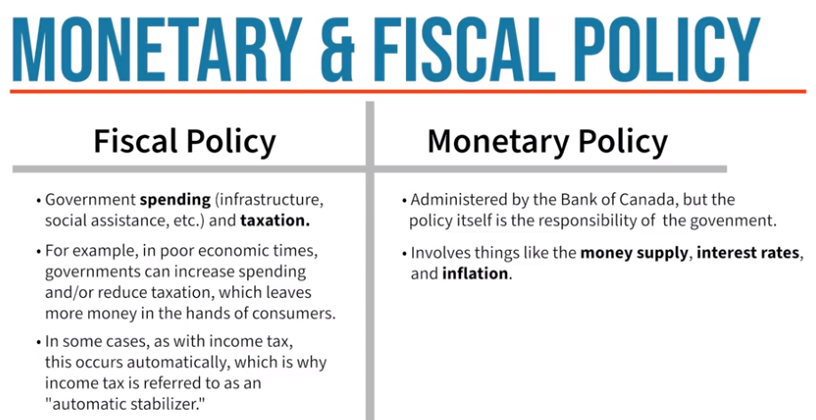

First, there’s fiscal policy, which deals with things like government spending and taxation. For example, in poor economic times, governments can increase spending and/or reduce taxation, which leaves more money in the hands of consumers. In some cases, as with income tax, this occurs automatically, which is why income tax is referred to as an automatic stabilizer. If household income decreases, income tax automatically decreases as well. Of course, the reverse is also true.

Secondly, there’s a monetary policy. While the Bank of Canada administers monetary policy independently, without day-to-day intervention by the government, the policy itself is the ultimate responsibility of the elected government. Monetary policy involves things like money supply, interest rates, and of course, inflation. For example, in poor economic times, lower interest rates may be desirable as it could encourage people to borrow and spend on big-ticket items, which could create jobs, increase tax revenues, and generally give the economy a boost.

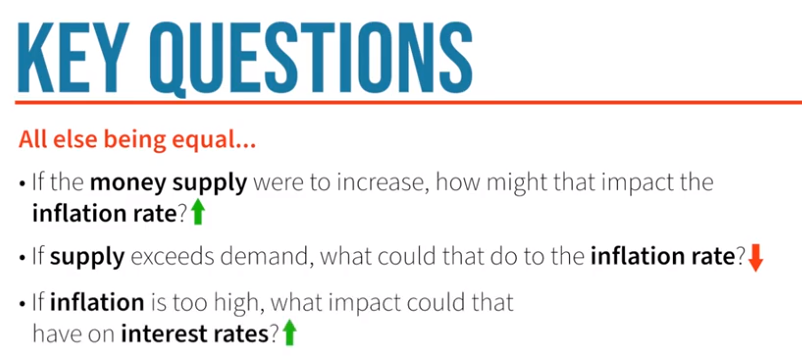

In last week’s video, we discussed what inflation is, how it’s measured, and the impact that an increase in money supply could, and I stressed the word could have on inflation. As I talked about in that video, there are many different forces at play that may impact inflation and interest rates. Fortunately, as a security student, you’re not going to be given a bunch of raw data on your exam and be asked to make a prediction about the possible effects on the economy. That sort of thing is best left to the economist. So instead, focus on understanding one variable in isolation, and the learning it will all come together for you gradually. For example, focus on being able to answer questions like this.

If the money supply were to increase, how might that impact the inflation rate? If supply exceeds demand, what could that do to the inflation rate? Or maybe if inflation is too high, what impact could that have on interest rates?

In next week’s video, we’re going to cover what deflation is and why it’s bad for an economy, the Bank of Canada’s target rate for acceptable inflation, and what could happen if inflation is above the acceptable level.

In the meantime, be sure to subscribe to our channel and click the notification bell so you’ll know when we upload a new video. And as always, we appreciate your nonpartisan comments. Thanks for dropping by the Coach’s Hangout and good luck on your upcoming exams.