We’re going to talk about ‘Settlement’. What is the accrued interest period on a bond that trades in the secondary market?

Hey, everybody. Andre here in the Coach’s Hangout. In today’s video blog, we’re going to talk about one of my favorite topics. We’re going to talk about ‘Settlement’. I’m sure I’m not alone when I say it’s nice when you finally get paid. In these Coach’s Hangout video blogs, we tend to focus more on multiple-choice style questions given most financial service exams are in that format. However, the vast majority of our full success packages include a wide range of study tools designed to expose you to the material in different ways, whether it be an easy-to-understand study guide, helpful video lessons like this one, flashcards; and of course, exam preparation questions with detailed explanations written by expert trainers.

Now, given the final exam is multiple-choice, some students may view the flashcards as rudimentary, like how a varsity baseball player may view T-ball, but our flashcards should not be overlooked as they allow you to cover a lot of ground very quickly. Completing a multiple-choice exam preparation question may take several minutes, whereas a flashcard can be completed in a matter of seconds, often imparting the same nugget of knowledge. The settlement date is the date where the security and payment change hands. A student may think they have the concept of the settlement date and accrued interest on bonds firmly under their belt because they’re getting all the math questions right. But they may have overlooked a subtle point that could still cost them a valuable mark on exam day.

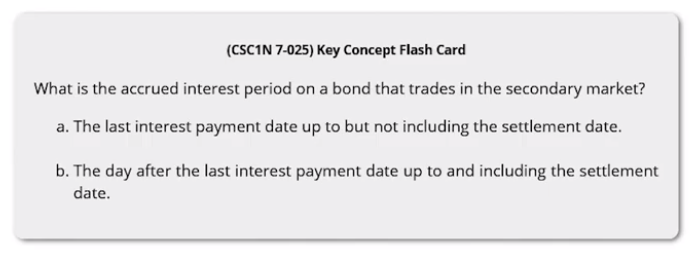

Check out this flashcard.

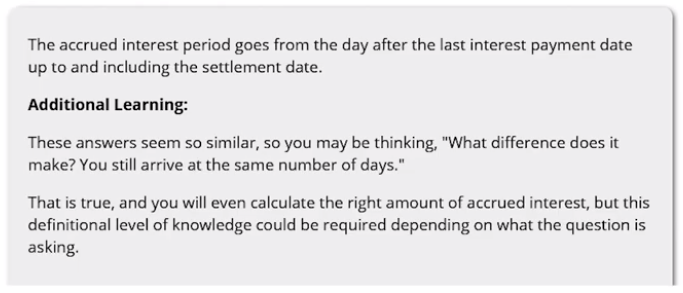

What is the accrued interest period on a bond that trades in the secondary market? Is it A, the last interest payment date up to, but not including the settlement date? Or is it B, the day after the last interest payment date up to and including the settlement date? These answers seem so similar. And whether a student thinks the answer is A or B, they would still arrive at the same number of days and could even calculate the right amount of accrued interest, which I’m sure one could argue is what really matters.

But nevertheless, this detailed level of knowledge could be required depending on what the question is asking. Now, you may have missed that one little line in the tax book, or perhaps you read it and thought, what difference does it make? That can’t be important. But fortunately, you were exposed to this flashcard. And a quick turn of the flashcard and the correct answer is revealed. The accrued interest period goes from the day after the last interest payment date up to and including the settlement date. This concept may also reappear when working through the exam preparation questions, giving you the opportunity to further apply what you’ve learned.

Thanks for popping by the Coach’s Hangout. And as a special thank you, here’s a pro tip. Be sure to subscribe to our YouTube channel. You’ll find a lot of great content, including a video where I cover this concept in more detail, by working through an accrued interest calculation. You’ll even find a video on the channel that shares a 10% discount code that works on any of our exam preparation packages available at seewhylearning.com.