One of the most challenging chapters in the Canadian securities course deals with alternative investments, such as hedge funds and the various strategies they use.

As a commerce graduate from the University of Guelph, I’m often asked by fellow gryphon alumni who are taking the Canadian Securities Course if I am understanding the textbook, do I still need SeeWhy Learning? My advice is yes.

Keep in mind. It is not the textbook’s role to provide you with helpful stories, analogies, or memory aids. That’s typically the student’s job. It takes skill, and it’s time consuming. Fortunately, you can delegate much of that work to SeeWhy Learning by investing in its exam preparation tools and study smart. The study tools will help you understand the content, greatly improve your results, and can save you a ton of time. There is true to the same time is money. It’s the most precious commodity we have. With that in mind, I appreciate you giving me a few moments of your time and I’ll show you what SeeWhy learning can do for you. It may even help you earn a mark on exam day.

For me, one of the most challenging chapters in the Canadian securities course deals with alternative investments, such as hedge funds and the various strategies they use. Without SeeWhy, I would have really struggled in this area. These complex strategies fall under three main categories, and you need to know which strategy falls under which category. How would you go about memorizing this list? Or perhaps a better question is, would you even try?

Now there’s no getting around the fact that this is going to take some old fashioned memory work, but let’s focus in on the relative value category, and a story designed to jog your memory.

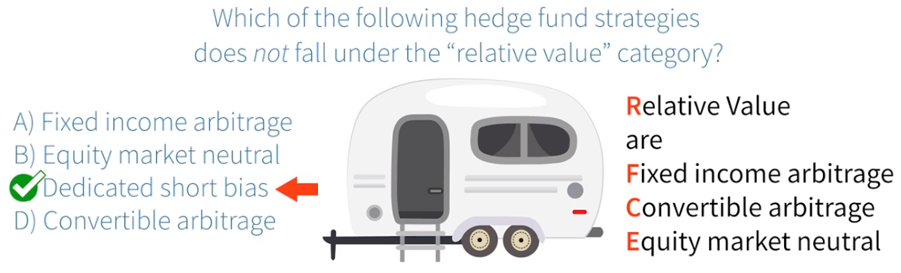

Check out this sample exam preparation question taken from the SeeWhy tools, which of the following hedge fund strategies does not fall under the relative value category? A, fixed income arbitrage. B, equity market neutral. C, dedicated short bias. D, convertible arbitrage. Tough question, right? Not if you’re studying with the SeeWhy learning study tools and recall this little story. Several years ago, I was at a long weekend music festival. I had an awesome time, but I had to sleep in a tent. My back still hurts thinking about it. The next year, I had the opportunity to sleep in a recreational vehicle, and trust me, RVs are fantastic camping equipment. This will help jog your memory. RV for relative value, F for fixed income arbitrage, C for convertible arbitrage, E for equity market neutral. Now I can easily see that answer C, dedicated short bias, does not fall in the relative value category and earn myself a mark. Relatively easy. Pun intended.

Pretty cool. Right? You may be wondering what about the other categories? The SeeWhy learning exam preparation tools are jam packed with tips like this. Some will help you understand the content while others will help you memorize something, and jog your memory on exam day. Gryphon alumni, I am counting on a like, and even if you attended a rival university, I hope you found this video helpful. And since you stuck with me till the end, I hope you throw me a like as well. Lastly, be sure to watch our YouTube video titled Bull, Bear, and Diversify to enter our back to school draw on September 1st for a $250 prepaid Visa gift card. And as always, to learn more about what SeeWhy can do for you, head on over to seewhylearning.com.