Discussing the Statement of Cash flows, “Depreciation is a non-cash item that is deducted on the Income Statement”. Canadian Securities Course®

Hey everybody, Andre back in the Coach’s Hangout.

Over the past month or so our YouTube videos have focused on several concepts found in the Canadian Securities Course® or the Mutual Funds Courses, and we’re going to continue that theme today. Now, if you’re going to be recommending equity securities, or even equity mutual funds, you don’t necessarily need to be an accountant, but you should have a basic understanding of how financial statements work. In this blog and video, we’re going to discuss the Statement of Cash flows, or as I like to call it, the Cash Flow Statement.

SeeWhy Learning understands that most students, including myself, would have a difficult time reading page after page of textbook material, trusting that was enough to understand and retain what they read and be successful on exam day. At SeeWhy Learning, our guiding principle is simple. Reading the material gives you a solid base knowledge, but it’s trial and error, in other words, a practice that takes you the rest of the way. Each time you do a practice question and read the detailed answer key, it will either confirm your understanding, which is great, or allow you to have that aha moment where the light bulb goes on and you learn something new, which maybe even better. This is why you’re studying.

For example, consider this piece of equipment that ABC Manufacturing owns. It was purchased last year for $10,000, but this year its book value is only $9,000. Now, fortunately, the $1,000 depreciation amount will be a tax-deductible expense for the company, despite it not being a cash item. In other words, it’s not like ABC physically cuts a check to someone for $1,000 worth of depreciation. The equipment is simply worth less than last year because its remaining lifespan is presumably one year less.

If this point is not crystal clear, consider your own vehicle. It’s probably worth less than it was last year, but you didn’t have to pay the difference in cash. It’s not like you got a bill in the mail for depreciation.

So with this in mind, let me ask you a question. Is a non-cash item, like depreciation, captured on the Cash Flow Statement? What do you think? Well, let’s take a look at an exam preparation question designed to trigger one of those ‘aha’ moments.

What is true of the statement of cash flows?

A) Depreciation is a non-cash item and is therefore not captured on this statement.

B) Any allowable depreciation expense is deducted on this statement.

C) Any allowable depreciation expense is added on this statement.

D) The main headings on this statement are operating activities, investing activities, and extraordinary income.

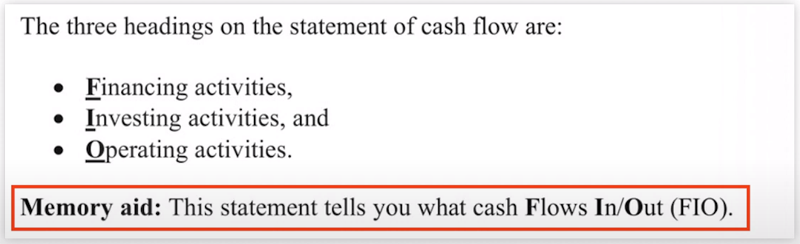

First, the SeeWhy Study Guide gives us a great memory aid to recall the three major headings on the statement of cash flows, which we can use to eliminate or select answer D. The memory aid is the Cash Flow Statement explains what cash flowed in/out. This will help you recall the three headings; F for financing activities, I for investing activities, and O for operating activities.

Now answer D includes extraordinary income, which is wrong, so we can eliminate this answer. With the remaining answers, it’s becoming clearer that getting this question right depends on knowing if and how depreciation is captured on the Cash Flow Statement.

What do you think? Is a non-cash item, like depreciation, captured on the Cash Flow Statement?

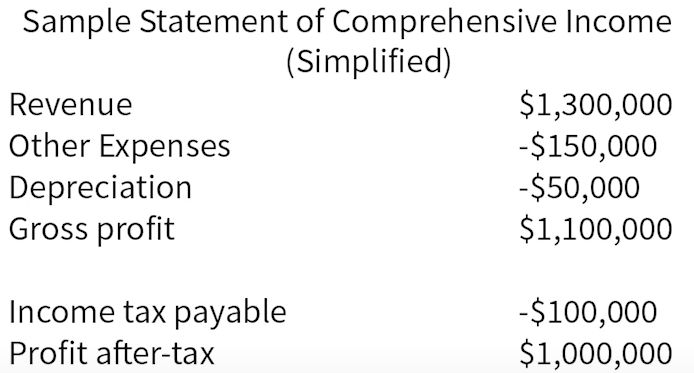

Let’s start with the ABC Statement of Comprehensive Income, also referred to as an Income Statement, as shown here.

You’ll notice that its after-tax profit is $1 million. However, that amount is not necessarily, and in fact rarely is, its net cash flow for the period. Take note of the following points. Although depreciation is a non-cash item, you’ll notice $50,000 was deducted on the Income Statement, and some cash items, such as dividends paid, which are paid with after-tax dollars, do not appear on the Income Statement. So obviously this means that the $1 million in after-tax profit is not the company’s net cash flow for the period.

Now let’s talk about the Cash Flow Statement. As you may have guessed by now, the Cash Flow Statement determines the company’s net cash flow. It may help to think of the construction of this statement in three basic steps.

- We start with the after-tax profit taken from the Income Statement, but from there, we need to make some adjustments.

- We reverse any non-cash items that appeared on the Statement of Comprehensive Income. For example, depreciation was deducted, but since it’s not a cash item, we add it back on the Cash Flow Statement because that cash didn’t actually go anywhere.

- We must account for any cash items that did not appear on the Income Statement. A good example is dividends, which is obviously paid in cash, but it’s paid with after-tax profits.

With all this in mind, let’s circle back to the question we referenced at the top of this blog/video.

We’ve learned that depreciation is a non-cash item that is deducted on the Income Statement. Therefore, on the Cash Flow Statement, we do a reversal and add it back in. So let’s go ahead and select answers C. And of course we are correct.

Now, if a student gets tricked here, they’re more likely to think, “What? How can that be?” But a good read of the answer key should clear up the confusion and lock in the learning.

Thanks for dropping by the Coach’s Hangout. If you found this blog and video helpful, we have a little bit of a fun competition going among the SeeWhy coaches. Please help me out by smashing that like button and subscribing. And of course, check out our fantastic lineup of exam preparation study tools available at seewhylearning.com.